Transform your workflow with our Inland Revenue-connected tools.

At Tax Traders, we make the tax system easy for you and your clients. One of the ways we do this is by automatically feeding your client’s IR data into our industry-leading tools and software. More than just a direct feed to up-to-date taxpayer data, our IR connection combines several benefits in one to make your job easier.

-

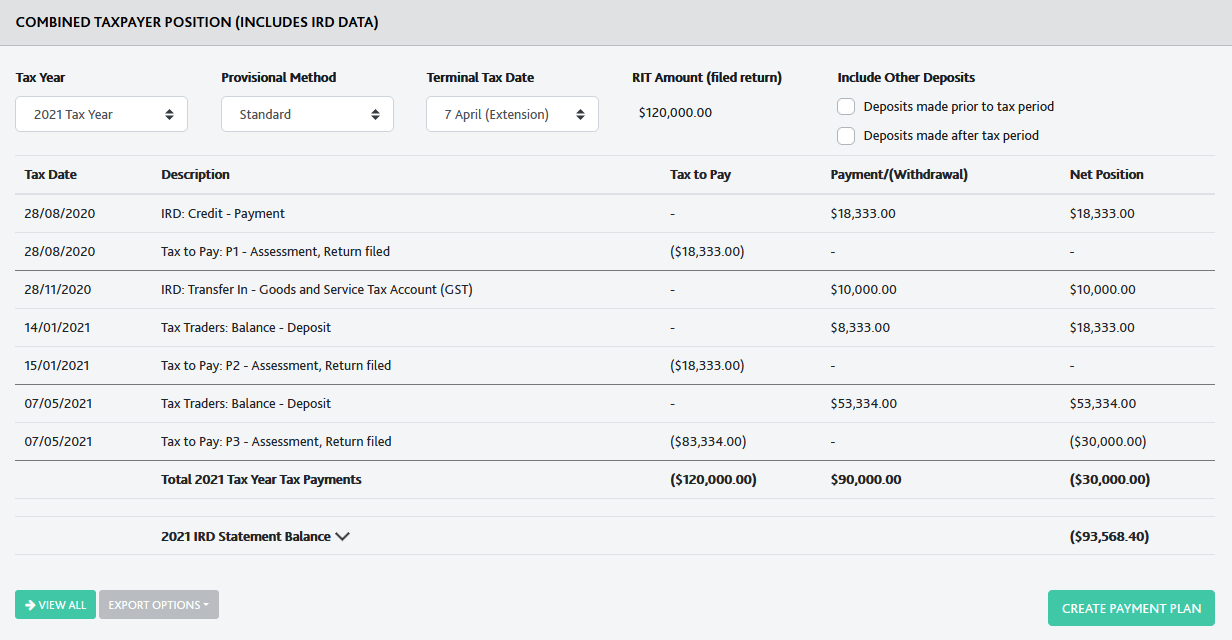

One report for managing your clients' positions

With tax pooling and IR data in one place, our combined report saves you from downloading and collating data from multiple sources into a spreadsheet. We're confident you won't find a more user-friendly, comprehensive combined report on the market.

-

Keep your clients on track

With all the important data in one place, you can easily see if a taxpayer is on track with payments and tailor your approach accordingly. If a client is at risk of late payment penalties and interest, you can instantly generate payment plans and put them in a better position. Alternatively, if a client is having a stronger or weaker year than anticipated, you can use the forecasting feature to help determine their obligations.

-

Fast, accurate purchases and transfers

Forget about entering IR data into the Tax Traders system to figure out your purchase amounts. Thanks to the IR feed data integration and RIT calculator, you can discover exactly what amount is owed, create payment plans and load transfers in one click. Accountants who use our IR connection estimate savings of up to 45 minutes per client when finalising a client's tax position.

-

Reduce the risk of errors and missed opportunities

By having a full view into a client’s obligations and balances, we can see when penalties and interest are starting to creep up and can help recommend purchases and transfers before the tax pooling window closes.

-

Being connected helps us, help you

When you are using our IR connection, we can also see your clients’ exact positions. If you ever need to reach out to us with a query on a specific client, we’ll be able to help right away. You won’t need to send us screenshots or multiple emails, and we can action your transactions faster than ever.

“Since moving to Tax Traders I’ve never looked back. My clients’ love the great range of payment options and their tools save me so much time.”

Thrive Chartered Accountants

Combined Taxpayer Position – example

Not yet a Tax Traders Advantage client? Make the switch today.

Enjoy exclusive benefits as a Tax Traders Advantage client, including access to our IR connection.

Already a Tax Traders Advantage client?

Get set up with our IR connection today.